Solo 401(k)

The best plan for the self-employed

Maximize tax deductions and invest in alternative assets tax free.

Maximize Contributions

Contribute up to $77,500, invest in alternative assets, and borrow up to $50,000 tax free.

Self-Direct Your Solo 401(k)

With checkbook control, invest in alternative assets without a custodian. Real estate investors can leverage their assets and pay no UBTI tax.

Hassle-Free Administration

No annual filing requirement unless account exceeds $250,000 in assets.

The Solo 401(k)

As trustee of the Solo 401(k), you will have the authority to make investment decisions without the consent of a custodian. Learn more

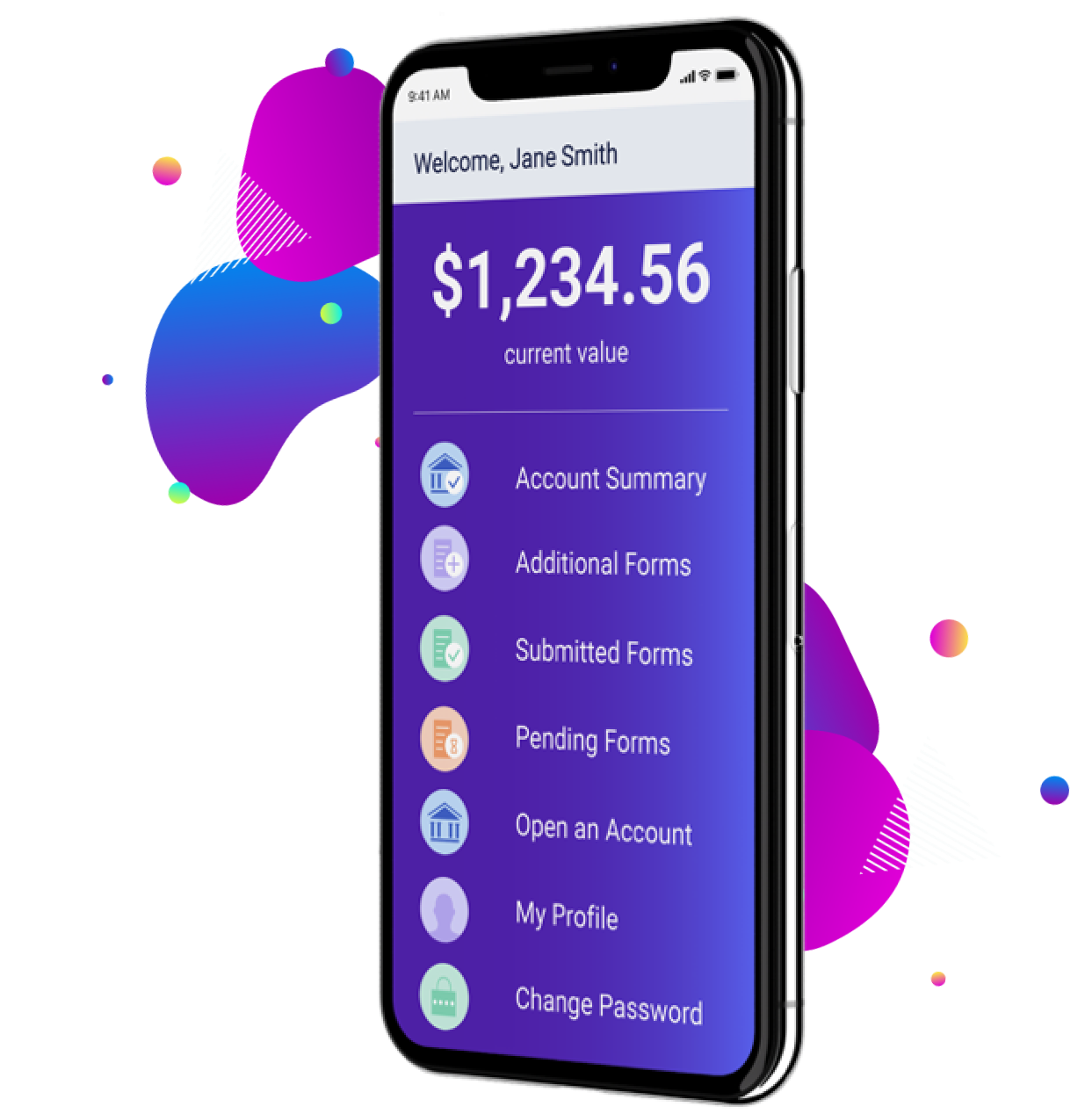

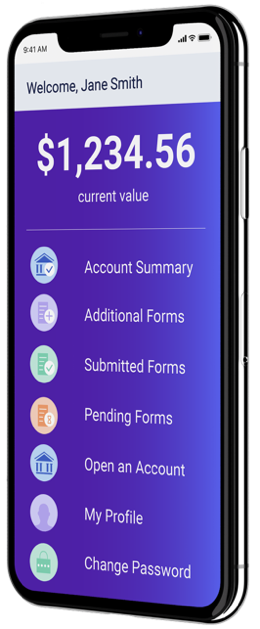

Do everything on our app

1. Open an account

Sign up in minutes with our app and open a self-directed account or call us at 800-472-1043.

2. Roll over funds

Perform a no-hassle and tax-free transfer or rollover of your retirement funds.

3. Invest

Invest in alternative assets like real estate and much more on your own.

We want to work with you

Individual, institution, or advisor—we’ll handle all your IRA or 401(k) alternative asset custody needs.

We Handle Everything

We open your self-directed bank account, handle all IRS reporting, and offer annual IRS compliance services.

Simple Pricing

Our self-directed plans have no account value fees, account management fees, or minimum balance requirement.

For Institutions & Advisors

Gain online access to client accounts and generate fees from your clients’ investments in alternative assets.

Download our info kit for more in-depth reading about the Solo 401(k)

Robust, easy to read, and updated for 2024. This guide is your one-stop shop for all the most important questions about the Solo 401(k).

Our fees

Our fees are simple and transparent.

What you can invest in

With a self-directed account, you can make almost any type of investment and generate tax-free gains.